First Published: 4th January 2023, written by Ciaran Clarke | Last Updated on 26th January 2024 | Reviewed and Edited by Chloe Safilo

Due to rising inflation and cost of living, typical English households are aiming for any discounts and savings for their regular purchases whenever possible. The majority of the time, the discounts we receive through coupons, special occasions, and other promotions aren’t applicable to the things we usually shop for.

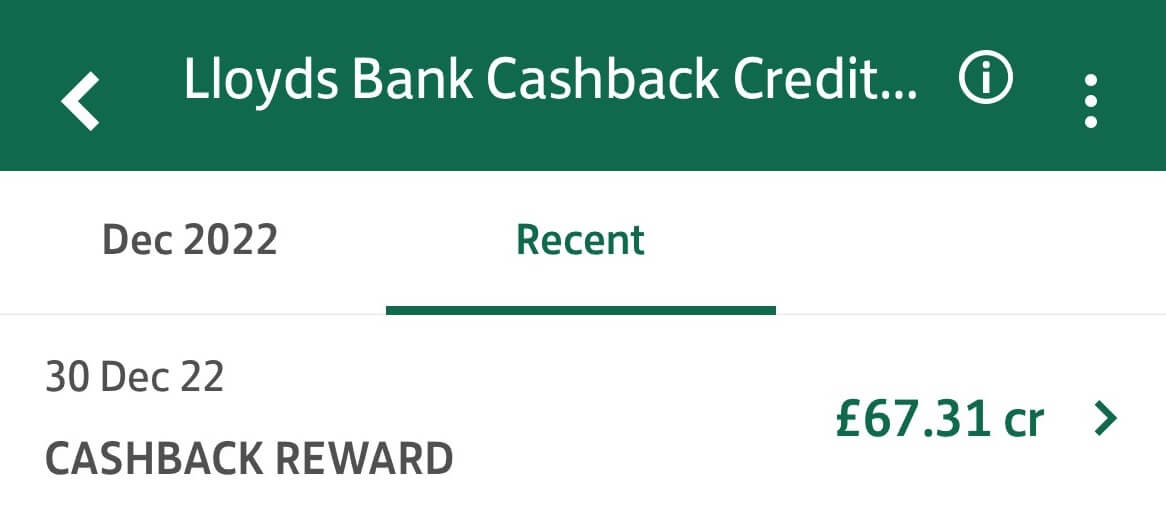

Another option for maximising your daily spend is credit card companies which give cashback rewards to customers to entice use of their cards for purchases. These could be points, air miles, or cashback. The plus side of these are they are automatically applied when making transactions and you get the added support of the credit card consumer act for when you shop online and in store.

What is cashback exactly?

In simplistic terms, cashback is a form of promotion employed by most credit card providers. It grants cardholders benefits when they utilize their cards for frequent purchases, such as when making purchases from any spend or purchase. It’s also worth checking for participating stores where you can garner an extra incentive and bonus.

For reference, this is different to UK cashback sites, which frequently use affiliate deals with retailers to get a percentage of your order value, in exchange for giving you cashback. This is applied when you go via the cashback website as it generates a unique landing page URL for tracking the sale for both the cashback site and retailer. The affiliate site then gets awarded a commission for driving the sale.

Using a cashback credit or debit card on the purchase is just your choice of payment method. It would be possible to use a cashback site, discount code and then a cashback card to pay for maximum return. Each are separate parts of the checkout process. Any retailer loyalty program is also in addition to the above, so the savvy shopper could quadruple their return in some cases.

So as an example if you:

- Find retailer on a cashback site offering savings and go to the site via their link

- Use any available discount codes from social media (not from discount code sites as often they want you to click the link as again they get the affiliate payment kickback negating your cashback site use)

- Make your purchase on a cashback debit or credit card

If this was on a £100 item, the savings could be:

- (10% discount added): £100 – £10 = £90

- (5% cashback site offer on £90 purchase): on £90 so £4.50 back (can be taken out as vouchers for an extra bonus)

- (2% cashback from using cashback credit card): on £90 so £1.80 back.

So you are getting the £100 at a total cost of £83.70 and any loyalty points would be on the £90 sale.

Point of note, these savings are covered by the retailer with the affiliate commission paid to the cashback site and the card processing fee applied by the banks to the merchant account for those rewards.

Is there cashback for debit cards?

Additionally, although cashback was previously only available via a credit card company’s rewards program, several financial institutions have started providing these kinds of cashback rewards via debit cards too.

You may use your debit card if available to get cash rewards. You are rewarded for money that already exists in your standard bank account, instead of the money borrowed from a bank which can limit overspending.

How does credit card cashback work?

Cashback credit cards promos provide similar benefits to debit cards. However, instead of receiving benefits for money in your account, the benefits you earn come from spending money borrowed on credit. You should check the small print though, the amount of return you may get on your purchases may be limited to when you can earn cashback.

Also, other credit card issuers may provide new customers with sign-up incentives if they sign in with a recently-obtained credit card and fulfil certain conditions. It may include greater interest rates and lead to increasing debt. You must keep spending habits and credit limits in mind to avoid drastically increasing your monetary debt to receive rewards. But, these kinds of credit cards provide a boost to your credit score if you pay on time.

One thing that is worth highlighting, ensure that if you are buying gift cards it is not treated as a cash withdrawal. This would then be generating interest even if paid in full by the cut off date and will generate a cash withdrawal charge.

Is cashback free money?

Since you must buy things to obtain cashback, it is technically not free, although you could argue that if you were making the purchase anyway it is free money. While other cards provide great benefits, these may also charge a yearly card charge or need a certain level of regular spend, which may negate your savings based on how often you use the card and expend money.

To make this fully clear, if you have a cashback credit card with no fee, and always pay it in full, you will benefit. If there is any fee or you pay interest, then you need to factor this in to your calculations.

To give you more knowledge on such cards, let’s discuss several additional benefits and drawbacks linked with cashback cards to help you properly evaluate if this is good for you.

Among the numerous benefits of cash-back cards is that most card companies will give consumers cash bonuses when they expend a specific sum of money, as long as they are spent within a provided duration. In addition, the majority of your daily transactions and purchasing locations will be eligible for cashback incentives.

Besides that, a good credit score gives you the chance to receive cards that offer greater benefits than others.

In terms of disadvantages, this is all about the particular cards terms and conditions. You should check things like any restrictions on the amount of money you may spend and collect points every year, and fees, and any other limits imposed. And bear in mind the interest on credit cards.

And of course, you may need to monitoring your spending to insure it does not increase with impulse purchases.

Before getting into a contractual arrangement with any credit lender, it is highly advised to contact your financial counsellor. By doing so, you can gain a clearer picture of your financial situation and guidance on how to constructively impact your present budgetary constraints and credit restrictions.

What is the cashback process?

It is crucial to remember that the cards that are offered, as well as how they function, will differ based on whatever company you select to establish a deal with.

To begin with, there are flat-rate cashback cards. The amount of money you earn back on every purchase might span from a fixed rate of around 1% to 5%, depending on the firm you keep your credit cards with. These percentages might fluctuate based on the purchasing category. Another option is to use rotating cashback cards. You might also be eligible for quarterly incentives. To provide customers with additional alternatives for their savings, credit institutions frequently provide rotating categories with good returns all year long, as opposed to those that last the entire year.

The bonus category is another form of rewards program given by lenders. These cards give you much more when you purchase and spend money on certain categories like department shopping, home improvement, travel, etc. A choose-your-own-category cashback card is the ultimate form of reward card. This sort of card gives the user more options in terms of what goods they may spend their funds on.

How are rewards redeemed?

Even though your rewards programs may range, the majority of corporations present their cardholders advantages in the way of bank deposits. It is where money earned via transactions made with the specific card will be immediately transferred via your account.

These cash backs may also be used to repay the credit card debt. This approach offsets your existing credit card debt, which could be a suitable choice for people who are using their card but are unable to pay it off regularly. Thirdly, your organization may give gift cards via various stores, both in-store and online. Many credit card issuers provide travel card choices where you may get airline tickets, hotel vouchers, travel points, and other rewards.

Conclusion

It is now clear that consumers who use their credit and debit cards to do transactions may take advantage of several perks thanks to cashback programs. When utilized wisely and carefully, options that let you choose how you save and get incentives may serve your gain. Before signing a contract with any credit institution, pay attention to the fine print and browse for rewards that will favourably impact instead of worsening your purchasing habits.